Thank goodness August is over. It was a horrible financial month. Unexpected or irregular expenses ranged from an impromptu trip to Cleveland, payoff off my vacation to Punta Cana that I never took, Spring tuition, and the unnecessary purchase of career suits. Yep...shopping. Consequently, I have moved to a cash only/ debit card system. No more credit cards!!!

During the Month of August, I did the following prep work:

* Opened a Bank of America “Keep the Change” checking and savings account

* Opened an ING Direct account and set up automatic monthly deposits of $100 -- Also received a $25 bonus

* Opened a ShareBuilder account and set up automatic monthly investments of $100 -- Also received a $50 bonus

* Set up $25 automatic savings transfer to BofA savings to avoid the monthly fee

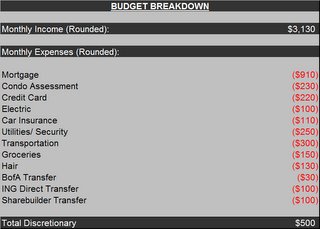

Here is my new monthly budget breakdown. It is going to be tight given my busy life of working full-time and going to law school part-time, but I am going to do my best to make it work. I am going to transfer my financial aid money, with the exception of $2K into my ING Account so that I only use the funds if absolutely necessary. I will have the 2K as a buffer for unexpected expenses. I am also expecting another $900 in tuition reimbursement this month, which I will likely also transfer to ING or open a HSBC account. I wish there was a bonus for that Bank...I would definitely open it then.