Monday, December 25, 2006

Thursday, December 21, 2006

November Recap…

Looking back at November, I don’t feel so bad. December will be another story with Christmas. Driving the decline in my net worth for November was the depreciation of my car and the interest capitalization on my student loans. I still spent too much on discretionary purchases to the tune of $1500, which was mostly eating out again. Overall, I don’t feel too bad but I am looking forward to my net worth improving in the near future.

I expect my net worth to decline for the next three months and then hopefully improve from then on out. For December, I have Christmas purchases, my tuition bill is due in January and I have bar exam fees due in February. I finish law school in May. My federal loans go into repayment six months later in December 2007 and my private loans go into repayment nine months later in February 2008. Oh joy!!!

Still no luck finding a job for next year but I am looking all the time and trying to meet with people to network.

Wednesday, December 13, 2006

Dodged a Shopping Bullet…

What did I do?

Shopped for everything I wanted and then closed the link before I purchased anything. Then I sent my mom and e-mail and told her to check out my shopping basked at JCrew for more Wish List ideas…

She is going to crack up laughing and do what???? Close the link too. LOL

Be a Millionaire...

CNNMoney.com has a article today called Be a Millionaire: 5 Ways to Get There.

The 5 ways highlighted in the article include the following:

- Make Saving Automatic

- Take Advantage of Uncle Sam

- Make Stocks Work for You

- Boost You Earning Power

- Don’t Stop Saving

Enjoy!

Monday, December 04, 2006

Blogging Vacation...

I got a rejection e-mail from one of the firms I interviewed with in October. All of their Summer Associates accepted their offers and therefore the firm satisfied their hiring needs for next year. Bummer!!! I haven’t heard back from one other firm so I sent my interviewer an e-mail for a recruiting status update this morning. I will post the results from that e-mail as well.

My 29th Birthday was great. I had a lot of fun over the weekend. My grandmother celebrated her 84th Birthday on Sunday so I have a lot to be thankful for.

Cheers!!!

Thursday, November 30, 2006

Gift Card Warning...

Here is an article from CNNMoney.com that warns about buying gift cards. Holiday shoppers click here.

Time for Final Exams…

I registered for my LAST AND FINAL SEMESTER of law school and I am gearing up to finish strong. No job offers yet but the operative word is YET! Something will come my way. Something good!

My 29th Birthday is on Saturday!!!

Wednesday, November 29, 2006

6 Ways to Cut Heating Bills…

In the meantime, CNNMoney.com has an article that details 6 ways to cut your heating bill. I know that changing over from a manual thermostat to a programmable thermostat has already reduced my electric bill considerably.

Check it out here.

Thursday, November 16, 2006

401k Contribution…

I decided to change my 401k contribution rate from 5% to 10%. This will amount to approximately $675 contributed each month. Although my employer only matches 5%, I know it is a good move in the right direction towards establishing a continuous pattern of saving. I was going to wait until next year but I can’t come up with a good answer for why I should put it off when I am blowing through cash and don’t have sufficient income at the moment for debt repayment.

Why change to 10% when I have so much debt?

It’s easy. I am simply out of control and living way beyond my means. I know that I won’t touch my retirement account so it is safe and out of harms (MY) way. Right now, it is the only method of savings that I have. I am going through the savings in my checking account left and right now with irregular and unexpected expenses popping up everywhere.

- Car Insurance Deductible = $250

- Passport = $100

- Sister's Destination Wedding = $1,600

- License Plate Renewal = $100

- Christmas = $1,000 Budget (just being realistic about this one – saved in ING account for Christmas)

It just makes sense to me to make sure I am doing something right. In my bleak state, here are some good things.

- Everything is paid on time.

- $50k in equity in my condo.

- I have been a homeowner since age 25.

- Graduate from law school in May 2007 – just 6 more months.

- Flexible repayment for student loans.

- Private loans don’t go into repayment until February 2008.

- Car is paid off and I am content with driving it for many more years.

- I am able-bodied to get a second job if necessary once law school is over.

- I have great employment credentials.

- I have the love and support of my family.

In the grand scheme of things, I am doing all right. Things will get better. I just need to stay focused on the big picture.

Wednesday, November 08, 2006

Lacking Motivation…

I am sincerely lacking motivation these days and yet, I have so much on my plate it’s crazy.

Here is a brief list…

- Working full-time

- School part-time – 4 nights a week

- Car accident – neck still hurts a little

- Mom recovering from knee surgery

- Sister getting married

- I have strep throat but feel much better

- Having a hard time trying to find a law job after graduation

- Student loan debt is piling high

- 25-page paper due in a month

- Class presentation in 2 weeks

- Final exams start in a month

Need I go on? I keep telling myself that I only have until May and then I graduate but any law student knows that graduation is when the REAL work starts. LOL Needless to say, I am at least looking forward to finals being over and getting a chance to relax.

Like most PF bloggers out there who may dread the purchase of Christmas gifts, I am looking forward to just spending some quality time with my family. Fortunately, with my upcoming graduation, my sisters nuptials, my mother’s retirement from teaching after 35 years, and my 30th Birthday (shhhhhh!!!!!), we are keeping gifts light and going heavy on having a good time with each other.

Tuesday, October 31, 2006

October 2006 Recap…

I am beginning to loathe these recaps but only because of MY bad financial behavior. I can deal with large expenses like tuition payments, new tires for my car or something like that but it’s my discretionary spending that is out of control. It is this blog that lets me know just how much!!!

Okay, here goes…

Snapshot:

- Blew through cash reserves

- 401k rocked this month

- Car value holding steady

- Still trying to deposit $100/month into savings

- Student loan interest is killing me

- Probably need to revalue my condo - neighbor sold 2bd/2ba for $155, I have a 3bd/2ba

- Opened WaMu high interest bearing online savings account – 5% current APR

- Withdrew ShareBuilder bonuses and transferred to ING – Moving ING funds to WaMu on November

Major Expenses:

- Quarterly Water Bill - $110

- Bar/Bri Prep Program - $170

- Car Tires and Brake Repair - $870

Next Month:

- Watch discretionary spending closely

- Move $2-3K into WaMu savings account – waiting for checks and debit card

- Pay for my trip to my sister’s wedding – need to get this secured and out of the way

- Pay for passport

- Pay $250 deductible for car repair

Monday, October 23, 2006

Neighbor Sold Condo…

I have a 3 bedroom, 2 bath that I purchased for $129k almost 3.5 years ago and he purchased 6 months after me. I currently value my condo at $150k so I think that after I sell my place, I can definitely net at least $50k in equity since my mortgage balance is down to $98.6k and I don’t plan to move for another 3 years. This money can go towards a new home purchase or the pay down of my student loans. Oh yeah!!!

New WaMu Account…

Working downtown in Chicago, there are a lot of WaMu braches and there are several that are near my home outside of the city. Like all other online savings account, the APY is subject to change but the account is fee free and I am able to access my funds a lot easier because there are so many braches nearby. I am going to probably switch to using this rather than HSBC but I will see how I like the account first.

Some other benefits…

The WaMu Free Checking account has:

- No minimum balance or direct deposit requirements

- Open with $1- Free basic checks for life

- No ATM fees on their end

- Free Gold Debit MasterCard® with Rewards—earn cash back on purchases!

- One free overdraft per year- Free outgoing wire transfers

The Statement Savings account has:

- A competitive 5.00% APY on all balances (rate only available online)

- No minimum balance requirements

- Open with $1- Instant transfer to/from the Free Checking

Thursday, October 19, 2006

When it Rains, it Pours…

So, all in all, I will have to pay my insurance deductible to get the work started on my car and get a rental but my car is drivable…just embarrassingly damaged. Besides, I don’t really blame the woman too much because she just moved here from the South and is unfamiliar with how fast Chicago moves and the sheer amount of one-way streets in Downtown Chicago. If you are new here, it can be very difficult.

The most important thing is that nobody got hurt. The car can be fixed but people are not replaceable and I am grateful that it wasn’t worse.

Tuesday, October 17, 2006

Waiting Period for Purchases…

So here goes…I am going to try a 30-day waiting period. Hopefully, I will be able to increase this to 60 days and eventually 90 days. In the end, I can try to save for whatever it is that I want during this waiting period.

I mulled the purchase of my new PDA/Cell phone for about 6 months before I purchased it and I am very happy with it. But by waiting the whole 90 days, I could have easily set aside $100/ month for the purchase and it wouldn’t have hit my pockets so hard. Plus, you never know if the urge to buy whatever will go away, if you will find something else that’s cheaper or if the item will go on sale.

Thanks Tricia!!!

Monday, October 16, 2006

October Update…

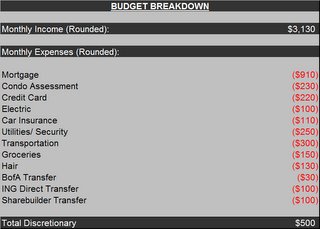

Monthly Income: $3,130 – After 5% 401k contribution

Savings: $300

Regular Bills/Expenses: $2,250

Discretionary Spending: $915

Irregular Expenses: $1,150

- Quarterly Water Bill - $110

- Bar/Bri Prep Program - $170

- Car Tires and Brake Repair - $870

Deficit: $1,485

Tuesday, October 10, 2006

September Recap...

Irregular Expenses: ~ $1,300 (OUCH!!!). I don’t have to tell you that this completely threw my budget out the window. Luckily, I got $900 extra in September in tuition reimbursement that helped out a lot.

Interview Expenses: $330

Law School MPRE Exam: $60

Car Repairs: $260

New PDA/Cell Phone: $380 - $100 Mail in Rebate so $280

New Computer Battery: $80

Garage Door Repair: $100

Birthday Gifts: $100

Discretionary Spending: ~ $1200. Once again, I spent way too much but I know it would have been worse using my CC. Not so much on clothing or anything like that, just eating out and entertainment spending. This spending would be in line with a salary in the $135k range, not my $54k salary.

Savings: I transferred $4,000 of my Savings into ING and have since transferred the funds back to my checking account. MY HSBC account is now up, running, and set to go and I just need to call and have them fax me the beneficiary form so I can fill it out and fax it back. Then I will transfer the $4K back and out of “harms way.”

Investments: I invested another $100 with Sharebuilder and that account is building nicely. We have to start somewhere right? In October, I deposited another $100 and should get the $50 and $25 bonuses in the coming weeks to add to my accounts as well.

Retirement: My 401k performed much better and almost doubled my contributions for the month. Oh yeah! My friend is a financial advisor so he did a new asset allocation for me and it is working out well.

Debt: Student loan interest continues to stack up and capitalize. I am grateful that this is my last year of law school so I can start paying some of this debt off soon.

General comments: Overall, a slight dip in net worth but nothing like last month. It will suffer another dip in January with my last tuition bill but from there on, it should be smooth sailing to financial freedom. I am still interviewing and have another interview this week. I am waiting to hear back from 2 firms that I interviewed with in September. Both are long shots but I am just as deserving as the next, hungry for the opportunity, and know that I can do a great job for whoever hires me. What is meant to be will be, I just have to continue to put my best foot forward.

Thursday, September 21, 2006

September Update…

September is moving right along. I am pleased to say that I’m loving the cash only system. It is absolutely wonderful. I will also say that I am less anal as well with balancing everything. While this may be a bad thing for some people, I think that it is working well for me because I was becoming obsessed with writing down every dime that I spent. I was spending so much anyway that 1) it didn’t help and 2) I never had time to go over my spreadsheets. So I use the Bank of America Keep the Change Checking account and use it solely for my personal spending. I am able to track it that way. I use my other bank account for unexpected expenses like my car repairs this month.

Car Repairs…

Speaking of car repairs, I just spent $260 to get my car serviced, including cooling and transmission flushing, oil change, tire rotation and winterizing. Right now, my car is 4 years old and has 45k miles on it. I drive about 100 miles a day, 4 days a week downtown to work. The dealership serviceman also told me that I would need 4 new tires before winter because they were near bald. This is scary business especially considering the sheer amount of driving that I do daily. So, I am going to do my research and try to find a good deal on the tires and have them replaced soon. Winter here in Chicago is approaching quickly.

Employment…

As many of you know, I had 2 call back interviews and I am in wait and see mode. I also haven’t heard back from another firm and sent them a follow-up letter that still expressed my interest. I would love to work for either firm and would be blessed to get an offer. I am still doing my best to network, network, network but it is extremely hard with my schedule and completely wrong and difficult to make personal calls from work regarding employment at another company. So, I am forced to make many of my calls from home on Fridays since I need a new cell phone and the only one have now is cheap and completely unreliable. Yet another expense that I will incur soon. I am going to bite the bullet and get one with a PDA because I need a way to keep up with my crazy life.

Savings/Investment Update…

Right now, I have approximately $4,400 in my ING accounts. Once my funds become available, I am looking to move my long-term savings of $4k to Emigrant since they have a beneficiary designation form. I will keep my short-term savings with ING and continue to fund it with $100 automatic investments every month. This account is for my sister’s wedding next year.

I opened another ShareBuilder account to get a $25 bonus. I am hoping to be able to invest $200/month into ShareBuilder. I chose SPY, which is the S&P 500 Index.

That’s it for now. Thanks for reading this long post. LOL!!!

Friday, September 15, 2006

Major ING Drawback...

So over the last 2 days, I’ve been thinking about the fact that I never signed a beneficiary form for my accounts...like I do with a traditional bank account. So, if something were to happen to me, the funds can go directly to that person. Since I’m not married and don’t have any children, my parents are the beneficiaries of my bank accounts, insurance, and retirement funds. Although I don’t have a trust established or a will (I will need to do this soon!!!), I know that they will receive everything because they are named beneficiaries using will substitutes. My condo is another issue.

I don’t share all of my financial business with my family so it’s not like they would know I have online savings accounts. The only other option that I have is to make the account a joint account and I don’t want to do that either.

Yes...I am leaning towards pulling my money soon. This is one I can’t get comfortable with especially since you never know what may happen in today’s day and age.

Wednesday, September 13, 2006

September Progress Report…

I am plowing my way through September. I had some job seeking related expenses like parking for interviews, new interview shoes (my other shoes hurt like hell), and some dry cleaning expenses. I know I need to curb my eating out expense but I don’t have the focus or energy right now with work, school, interviewing, etc. That’s enough right! LOL

Anyway…I am still waiting for a $900 tuition reimbursement check. I opened a new ING account and deposited $4k of my savings. I will deposit additional funds at the end of the month because I still have about $4k sitting in my checking account and I want to have that number around $2k.

Can anyone tell be about their experience with HSBC? They have a better savings rate than ING so I may look to transfer my long-term savings/ debt repayment funds into that account.

So far, I have approximately $45 in my Bank of America Savings account from the automatic $25 monthly checking transfer and regular Keep the Change deposits from my checking account debit transactions. I will be transferring the balance of that account to my ING account at the end of the month.

Thanks a bunch!!!

Thursday, September 07, 2006

August Recap…

For September, I moved to an all cash/debit system. We’ll see how that works out.

Snapshot:

- 401k performed better.

- Increase in cash balances are financial aid funds that I need to move over to ING.

- Opened an ING and Sharebuilder account.

- New student loans are all federal. No private loans. I went with the new Federal Grad Plus loan so that my interest rate will be maxed out at 8.5%.

- Next month should be a lot better. I am contributing $25/month to my savings account to avoid account fees and $100/month to ING and Sharebuilder (S&P 500). At the end of the month, I will be transferring all savings from the Keep the Change program to ING which should be in excess of $40 with the $25 savings deposit as well.

Wednesday, September 06, 2006

My Neighbor is Moving…

Currently, I value my condo at $150k. I may be undervaluing my place so I will be keeping a close watch and may get to adjust the value of my condo, especially with the upgrades that I completed in February.

As it stands, once I finish with law school, I will have approximately $100k in private student loans and $110k in federal student loans. I am hoping to secure a legal position that will boost my income considerably from my current $55k. After a year or two, I hope to save and pay down as much of my student loan debt as possible, contributing all bonuses, tax returns, and extra funds towards debt repayment. It is my ultimate hope that with the sale of my place in the next 3 years, I will be able to completely pay off my private loans, especially with $60k in equity in my home already. Then I will be left with a federal loan payment of approximately $500, that will decrease to ~ $300/month with the pay-off my new federal grad plus loan and last year of regular federal loans that I will not consolidate due to the inreased interest rate.

Lofty goals? Of course…why settle for less.

Thursday, August 31, 2006

Good Old September...

Thank goodness August is over. It was a horrible financial month. Unexpected or irregular expenses ranged from an impromptu trip to Cleveland, payoff off my vacation to Punta Cana that I never took, Spring tuition, and the unnecessary purchase of career suits. Yep...shopping. Consequently, I have moved to a cash only/ debit card system. No more credit cards!!!

During the Month of August, I did the following prep work:

* Opened a Bank of America “Keep the Change” checking and savings account

* Opened an ING Direct account and set up automatic monthly deposits of $100 -- Also received a $25 bonus

* Opened a ShareBuilder account and set up automatic monthly investments of $100 -- Also received a $50 bonus

* Set up $25 automatic savings transfer to BofA savings to avoid the monthly fee

Here is my new monthly budget breakdown. It is going to be tight given my busy life of working full-time and going to law school part-time, but I am going to do my best to make it work. I am going to transfer my financial aid money, with the exception of $2K into my ING Account so that I only use the funds if absolutely necessary. I will have the 2K as a buffer for unexpected expenses. I am also expecting another $900 in tuition reimbursement this month, which I will likely also transfer to ING or open a HSBC account. I wish there was a bonus for that Bank...I would definitely open it then.

Tuesday, August 29, 2006

Opened a ShareBuilder Account…

For now, I also elected to transfer $100/month to fund my account. I used the ShareBuilder financial model to assess my risk tolerance and I came out with a Moderate profile. As of right now, my funds will be invested into two ETF funds…

What do you think?

Sunday, August 27, 2006

Back from Ohio...

The way a lot of mid-size/large law firms work, is that they hire so many law students to become summer associates at their firm during the summer. If the law student performs well and demonstrates the potential to be a solid attorney, then they are extended a job offer to join the firm after taking the bar exam.

Unfortunately for me, I never completed a summer associate position because I was a full-time worker and part-time student. I am regretting that decision right now but it was never a given that I would have been extended an offer for a summer associate position. Now, I am working to secure a job for next year.

One thing that I am very willing to do since I am not nearing the end of law school and a career change, is to leave my current employment situation and complete a summer associate position if the firm would also allow me to clerk in their offices during the next year. I may be able to secure a judicial clerkship as well.

So much to decide...so much hustling...but anything worth having, is worth working for.

Wednesday, August 23, 2006

Going to Ohio...

The bad thing??????

$350.00 that I did NOT plan to spend this weekend but the reward can possibly be much, much sweeter!!!

Wish me GOOD luck!!!!

Sticking to a Budget…

How do you handle unexpected expenses when you are sticking to a tight budget?

It seems like something is always coming up, a wedding, birthday, license plate renewal, and of course…Christmas! How do you plan for these expenses and how to you simply decide that you cannot afford it?

For me, the answer has always been the dreaded CREDIT CARD! That was my solution. I would just put it all on the credit card and worry about it later because I never wanted to feel like I couldn’t do something for someone or take care of business when necessary.

What happened? Over $20,000 in credit card debt!!! (Ouch)

I feel bad. One of my friends is getting married Labor Day weekend and the only reason that I'm not going is because I know I can't afford to go. I would feel like I had to write out a check for $100/$150 for me and then double it if I brought a guest and I just couldn’t do it. I hope it won’t always be like this.

Tuesday, August 22, 2006

No More Credit Cards…

Job update: No job so far. I received a rejection call and rejection letter from 2 employers I interviewed with at the Job Fair. One firm even spelled my name wrong. Addressed me as Mr. Chitown instead of Ms. Chitown. Small mistake but still a slight smack in the face when you are already rejecting me. What does that mean? More motivation to get a better job at a better firm and make an even larger contribution to the practice of law.

Hope everyone is well!

Wednesday, August 16, 2006

On Vacation...

I am working out a financial plan for the rest of the year right now. I established automatic savings with ING to deposit $100/month and will look sometime at the beginning of the year to double that amount.

For now I just want my CC/HELOC paid off by the end of February, to land a good paying job for next year, to work out a feasible budget that does not include credit cards, and to start my new job in September with $20k in savings. I know it is ambitious, but with my bonus, tax return, and tuition reimbursement, I should manage. We’ll see.

Thursday, August 10, 2006

Interviews Tomorrow…

Last night I went over to school to participate in a Mock Interview. It went well although my interviewer did say that she could tell I was nervous. Other than that, she said that I came across very professional, eloquent, and polished. (Thumbs up!) She just said to go into the interviews as if I have nothing to lose. Great advice. =)

So, that’s it…I pray everything goes well and that I am fortunate enough to get a call back, a second interview and a job offer.

Tuesday, August 08, 2006

Productive Morning…

No more credit card use for me. I am done, done, done!

I am on vacation next week from work and that’s where I will jump start making lunches and dinner again and eating out less. (Hopefully…I am on vacation.) I am going to hold of on the Sharebuilder account for now and just focus on trying to deposit $50-$100 into my ING account every month until I can get use to this whole budget/cash thing.

Hope everyone is well. I just wanted to post on my progress!!!

Monday, August 07, 2006

Best Friend’s Wedding is Over…

Now it is time to regroup the finances. I took Sunday just to relax, read a little for enjoyment and visit with my parents for dinner. But now I am back to business. This Friday I have a Job Fair to attend and I have 3 interviews with a mid-size firm, a small firm, and a corporation. Wish me good luck!!! I really hope that something positive comes out of these interviews so I don’t have to relocate. My heart and soul rests in Chicago.

For now, I don’t anticipate any additional large expenses for the remainder of the year. Of course I am excluding Christmas. Next year will be a busy year for my family with my graduation, my mom’s retirement from teaching, and my sister’s wedding. Plus, I turn 30 next year, so I know I am going to want a bash for that big and special occasion. Did I just say 30????????? (Chitowngirl shakes her head in disbelief!)

Hope everyone is well. Thanks for checking in on me. Cheers!!!

Wednesday, August 02, 2006

My Credit Card Use…

As I finish my last year of law school, budgeting is even more a priority. I will have to begin repaying my private student loans 9 months after graduation and my federal consolidated loan goes into repayment immediately. Since this is my last year of law school, I have a small window of time to establish better spending habits.

I am still going to open an ING account and a Sharebuilder account and I want to deposit $50 in each account when I get paid (once a month). While I agree that the Bank of America Keep the Change Program is not entirely attractive given the low interest rate on the savings account, I think I will go ahead and open an account. Anything transferred in the savings account will get swept into a higher interest bearing account at the beginning of the month, when I make my new $50 contribution.

I just need to get better hold on my spending NOW!

Thursday, July 27, 2006

July Recap...

Snapshot:

- Positive change in net worth primarily due to less spending and tuition reimbursement

- 401k bounced back a little

- Everyday CC use was paid in full and paid down HELOC/CC by $200

- Student loan interest is capitalizing and building fast

Looking Forward:

- Pay off my everyday CC use in full including the vacation I had to cancel

- Continue to contribute to my 401k

- Open a Sharebuilder account to take advantage of $50 bonus - Are there any out there?

- Contribute at least $50/month to Sharebuilder account

- Open an ING account to take advantage of a referral bonus – Are there any out there?

- Contribute at least $50/month to ING account.

- Spend less, smile more, and GET A NEW JOB FOR NEXT YEAR!!!

Monday, July 24, 2006

I’m Free…

Now I have to get ready for the August job fair. Through the bidding process, I got 3 interviews and I am really excited. I hope everything goes well and that I get an offer! I know that I am a really hard worker and that I will do a good job for whoever hires me. Most of the time, the hardest part is getting your foot in the door. I will also be attending 2 other job fairs in the next few months so hopefully something good will come my way.

Needless to say, a job at a firm would substantially increase my income. If I am fortunate enough to receive an offer and work for a firm, I will have to go into serious debt reduction. The question will be…Should I invest simultaneously with debt reduction or should I try to pay off as much as possible in the first few years. No matter what, I am committed to saving for my retirement so this question pertains solely to outside investments.

What do you think?

Monday, July 17, 2006

Update and Final Exams...

Oh yeah...Can’t wait for this class to be over.

It is supposedly gorgeously hot today here in Chicago but I doubt that I will venture out into the heat. I hardly ever complain about the hot weather especially since you know the cold freeze of the Windy City will return with a vengeance. LOL. I love this city.

Finances are looking up. I returned a lot of the interview stuff that I bought for a few upcoming job fairs and decided on two skirt suits, black and gray, for a conservative look. I really hope that I get an offer from these Job Fairs because it is so hard for an Evening Student to get legal experience and that can work against us.

I booked a vacation with Apple Vacations but then someone told me that it was not a wise decision to be out of the country just in case I do receive a callback. So I called today to cancel the trip and hopefully everything will work out. Push come to shove, I will at the least get a travel voucher that will be good for one year.

Other than that, my mom is finally home from the physical rehabilitation facility and her knee is doing really well. My Uncle is supposed to come home from the hospital this week but will still continue his chemo treatments for several weeks to come.

My Best Friend is getting married in less than 3 weeks and her bachelorette party has yet to be planned but I am putting that expense and event on the other bridesmaids since they did not help with the Engagement Party or the Bridal Shower. No major expense for me there and luckily, my dress doesn’t need to be altered so that is one less expense I have to worry about.

Oh yeah!!!

Wednesday, July 12, 2006

June Recap…

Snapshot:

- Falling down a slippery slope with my spending.

- Not much change in Assets.

- 401k performed poorly again - Total $450 contribution and only a $41 increase.

- Liabilities increased dramatically by $7M primarily due to new Summer School Loan.

- Paid down HELOC CC balance by $3k - 1.9% CC balance transfer offer until January 2007.

- $6,634 decline in net worth – summer school class and payoff of regular CC in full

Lack of Posts…

Finances are struggling a bit but that is somewhat expected with all that is going on. I am making a splurge and going away on a vacation in August. I shouldn’t but I feel like if I don’t take some time away from home, work, school, family, etc…You get the point. LOL I am not going overboard at all and it will actually be a cheap vacation compared to most.

My mother is still in the rehabilitation facility getting stronger after her knee replacement surgery so I have been trying to visit with her as much as possible so she doesn't get lonely up there.

My Uncle was just diagnosed with a very treatable type of throat cancer and was admitted into the hospital on the 4th of July. We almost lost him after complications from surgery but he is stabilized and getting stronger so I have been visiting him in the hospital as well.

My sister got engaged yesterday while vacationing in Jamaica so she will begin wedding planning once she returns. I will be the Maid of Honor, which means of course…Cha Ching!

I have a June financial update and will post it later this afternoon. Thank you for those who have stayed with me despite the lack of posts but there is just too much going on for words. Including Summer Law School Finals. Oh Boy!

Tuesday, June 27, 2006

Bad Month…

I apologize for the scarce posting. I’ve been very preoccupied with hosting the shower and prepararing for my mom's knee surgery. Financial recap to come this weekend and I will resume more regular posting next month.

Wednesday, June 21, 2006

Update…

Next month I plan to pay down the balance on my HELOC/CC to $4,500 with tuition reimbursement from my employer. I finally got the last of my grades and while I did not make the Dean’s List again, my GPA remains virtually unchanged. Now that I have my grades, I can submit the forms for reimbursement. The $4,500 payment will bring the balance down to $15,500. I have to get this paid down to $0 by February 2007 when the rate on the balance transfer increases.

Not much else to report other than spending, spending, and more spending. I just need to get through July and then all will calm back down for me when my best friend’s wedding is over and the Fall semester starts. I cannot wait to put this final year of law school behind me so I can actually live a fuller life. Right now, it’s all about work and school. Next year I hope that it will be about work and family again.

Thursday, June 15, 2006

Need Comments on Future Hopes…

Tomorrow morning I have a notary coming over to my place so I can sign the documents to increase my HELOC from $26k to $50k. The pre-approval for the offer let me know that my place has increased in value and I am really excited. Why increase my line of credit? Why not?

The balance on the HELOC is still $0 with no plans to use the line any time soon. I am steadily paying down my CC balance, which is the result of refinancing my $26k HELOC. The current balance on my CC is now $20,000. So, I’ve paid it down almost $6k in the last 2 months, primarily using savings and reimbursements. I am still waiting for one grade from last semester. Then I can submit my forms for tuition reimbursement. That’s another $4,500 that I will use to pay down my CC.

I hope to eventually purchase investment rental property. I’ve wanted to do it for some time and even contemplated my first home purchase to be a 2-flat where I live in one unit and rent out the other. Unfortunately, when it came time to purchase, law school was starting in a month and I didn’t have the time to fully research, property search, and find out the true extent of becoming a landlord. Since a home purchase is nothing to rush into, I knew the same rule applied for investment property.

My hope is to get a job as an attorney next year once I finish law school and to eventually purchase my first property. I am curious to know people’s thoughts on leveraging on your primary residence to purchase an investment property.

Specifically, do you think it is a bad idea to use my $50,000 HELOC to purchase/place a down payment on an investment property in the near future, 1-2 years from now?

Saturday, June 10, 2006

CC Plan...

So here is the plan...

$2,500*8 = $20,000.

Tuesday, June 06, 2006

May Net Worth Recap…

Way over budget due to overspending. Refinanced HELOC with 1.9% CC balance transfer offer until January 2007.

Used some savings to pay off remainder of HELOC balance.

$1,100 decline in net worth.

401k performed bad. With total $450 personal contribution and employer match, only a $85 increase.

Eating out: I didn’t cook at all in May due to busy schedule with Finals. This took a major toll on cash flow and I spent much more than I normally would because I was also trying to eat healthier on the go. (June isn’t going much better but I still have time to save myself!)

Irregular expenses: Irregular expenses for the month totaled $1,005 primarily due to Mother’s Day and I had to lend a friend of mine $600 (Trust…I don’t expect to get it back). I made a hard decision to give the money to my friend. While I normally do not do this, it was something I felt I needed to do and I never lend money with the expectation that I will get it back. If I do then that is wonderful but if I don’t, then I knew that going into it. Money and friends isn’t something that mixes well. I learned that lesson before the hard way.

Personal expenses: I overspend on clothes this month and eating out. I did so poorly and have no excuses. I returned virtually everything due to buyer’s remorse and an obscene credit card bill. The people at J Crew are just wonderful. They delivered the best customer service and didn’t even flinch when the clothes were returned. I love that store!

Summary: I decided to leave out my summer student loan and include it in next month’s net worth tally since I did not receive the proceeds from the loan distribution until June. Going forward, I will be contributing $400/month towards by CC balance in addition to any loan and tuition refunds. One that is paid off, then I will begin to apply cash flow to the repayment of my private student loans, starting with the lowest balance first since they have pretty much the same interest rate. Then I will snowball the payments. Next month’s net worth will also reflect the payoff of my CC in full.

Wowza…I am dreading my spreadsheet for next month.

Saturday, June 03, 2006

Returned Remainder of Clothes...

It is so beautiful outside today here in Chicago. My sister’s boyfriend is on his way over in a little while to put my grill together. Then I will be grilling to my heart’s content. Time to clean out that freezer!!!

Friday, June 02, 2006

Craziness...

$60 - invitations

$25 - postage

$35 - color printer ink

In retrospect, I should have just ordered pre-printed invites. I am tired of learning these lessons. I thought I was making out better by making them myself. I hope the other bridesmaid’s don’t stiff me when it comes down to their contribution towards expenses.

I need to get a handle on this because there are 9 of us and so far, I am the only one doing anything. As the Maid of Honor, I know I have a bigger role to play but come on, won’t anyone call to see what needs to be done? Just ranting...

Tuesday, May 30, 2006

Relaxing Weekend…

The financial month is over and I have a few trailing issues to resolve. Then I will be posting the results. Since the payout on my CC will not happen until the middle of the month, my May recap won’t look as bad as June which will reflect the payoff of my CC in full. I will have another dip in my net worth because of the payment for my summer class. Overall, it won’t be too bad but June should be a lot better in terms of spending than May.

Friday, May 26, 2006

4 Day Weekend...

One thing about working full-time and attending class 4 nights a week is the lack of time. Consequently, my health has taken a beating and I have gained about 10 lbs, if not 15 lbs. I refuse to get on the scale. =) Do I need new clothes? Sure. But I could also be just fine by losing the 10 lbs I gained so I can fit into all of my clothes comfortably again. Plus, I really don’t want to spend any large amounts of money on anything until I get my CC paid off from refinancing my HELOC.

I have to do better with my finances and my health. So I am going to kick start a workout program this weekend since I only have summer classes twice a week and more time. I am also going to get back to cooking which will help my finances considerably. I am at $1,100 this month for eating out and groceries all because I chucked cooking and ate out almost every day and on the weekend. Sooo bad and I have nothing to show for it at all. Bummer.

So that is my plan for the weekend. My boyfriend is on a plane to Miami in about an hour and I wish he could have fit me into his suitcase. LOL. Luckily it will be a nice weekend here in Chicago.

Thursday, May 25, 2006

Got a Call Back…

I sort of knew that the Senior position was a long shot but it is still attainable especially once I have experience and I complete my degree. In reality I was hoping for somewhere between the midpoint and the maximum salary for the job grade, with the midpoint at $67k and the maximum at $86k. $75k would be lovely for the transition and would afford me sufficient income in the interim to pay down debt, prepare for the arrival of my student loan payments, and try to obtain a higher paying job.

My fingers are still crossed. The woman said she was going to forward my information and application to the hiring manager. That’s good news. I should hear something in the next week.

Wednesday, May 24, 2006

Link Love…

Applied for New Job…

I am hoping to get an interview and an opportunity to transfer within the company. This would avoid the need to leave my employer to gain legal experience. Since I want to practice law, I will leave my current job if I have to and seek out clerking opportunities.

Wish me luck!!!

Monday, May 22, 2006

I’m Done...

I looked at my CC balances on Sunday night and got the shock of my life. J Crew really got me and I will be returning a few items before my CC closing date so I can pay the balance in full. No excuses…Paid in Full!

I really want to go somewhere this weekend but I know that’s not going to happen. The beach has been calling my name but I guess I will have to settle for Lake Michigan. =) I might go out this weekend with my parents to the discount stores to look for some patio furniture. I love sitting outside in the summer and reading. It’s relaxing and I live in a really quiet subdivision. My hope is to one day own a home with a deck so I can sit out and perhaps entertain.

My BF is heading down to Miami this weekend with the guys so I will be trying to entertain myself. Not sure what I will do for the long weekend but I know relaxing is somewhere on the list as well as returning clothes. LOL.

Thursday, May 18, 2006

Confession...

Thank Goodness...

I just broke the bank and bought tickets to see Alvin Ailey on Sunday. It is my treat for finishing my 3rd year of school. I am so excited!!!

Tuesday, May 16, 2006

MBNA Reversed the Balance Transfer Fee…

Even though I vowed not to let one rude customer service representative tarnish the business relationship I have with MBNA, it is nice to know that they are on top of their game.

This was a very nice way to begin my morning. BTW…3 Final exams down and just 1 more to go!

Monday, May 15, 2006

I'm Alive...Barely

It is about 3:30 in the morning right now and I have my 3rd exam in less than 15 hours. I better get some sleep. Next Friday is my last exam and then I’m finished with my 3rd year of law school. Just one more year to go...Yippee!!!

Tuesday, May 09, 2006

Transfer Fee and Poor Customer Service…

I told the woman that I initiated a balance transfer last week and was told by the account representative that the fee would be waived. She tells me that it wasn’t noted on my account and that I would be responsible for the fee. I told her NO I am not because I was told that the fee would be waived if I transferred the balance that day. Not only did I do this but I had the woman repeat it like 5 times that there would be no fee.

So once again the woman today tells me that I am responsible for the fee and once again I tell her NO I AM NOT. Then I ask her to let me speak to her supervisor and she promptly tells me…Thank you for calling “cc company and have a great day” without transferring me to a supervisor and then hanging up on me.

Okay I am at work so I need to take a DEEP BREATH and call the CC company back tonight when 1) I get home, 2) after I’ve calmed down and 3) so no other person can hear how annoyed I am right now.

Monday, May 08, 2006

Balance Transfer and Applying for New Job...

I think that I made up my mind to apply for an open position at my current place of employment. The position could increase my income since the job grade is higher. It will also allow be to use my legal skills and give me the opportunity to develop additional transferable skills for when I try to secure a law job for next year. I know it would be the right move but is kind of scary at the same time. I’ve been an analyst since I graduated from undergrad and I’m comfortable...too comfortable. So I am going to take the plunge and see if I can get the position. If I don’t, I might have to consider leaving so that I can get some legal experience before I graduate.

Saturday, May 06, 2006

High Stress = High Spending...

Right now I am studying for law school finals (First exam is on Wednesday), revising my resume, preparing to apply for a new job, and doing prep work for an August job fair where all info must be submitted by next Friday.

So what does that mean? A lot of eating out on the fly, no cooking, lots of coffee, and Chitowngirl seriously over budget. I already spent my personal, irregular, and grocery budget for the month and it is on the 6th. I am sooooo in trouble. Thank goodness for savings. =)

Wednesday, May 03, 2006

Initiated CC Balance Transfer to Pay Off HELOC…

So the current balance of my HELOC at 10.25% will be paid off from the transfer and savings and then I will attack the new balance on the credit card. This should leave me with just over $3,000 in savings, which will be just fine. I certainly plan to have the card paid off by February. If I don’t, the rate on my credit card is still better than my HELOC at the moment and I can always transfer the balance back to the HELOC if necessary. NOT!!! =)

Tuesday, May 02, 2006

April 2006 Comparison to the 60% Solution…

60% Solution Plan: The idea is to keep committed expenses to 60% of your gross income and divide the remaining 40% into Fun Money, Irregular Expenses, Long-term Savings or Debt Repayment, and Retirement.

60% Solution Plan: The idea is to keep committed expenses to 60% of your gross income and divide the remaining 40% into Fun Money, Irregular Expenses, Long-term Savings or Debt Repayment, and Retirement.Committed Expenses: Basic food and clothing needs, essential household expenses, insurance premiums, charitable contributions, all bills including non-essentials such as cable, and all taxes, dues, and social security.

Fun Money: Anything you want to spend money on but capped at 10% of gross income.

Irregular Expenses: Vacation, repairs, appliances, gifts, and other less predictable expenses.

Long-Term Savings or Debt Repayment: Long-term savings are automatically deducted to buy long-term investments that are less liquid such as stocks. The idea is to make it harder to spend the money but if necessary the assets can be liquidated and the funds wired to your account. Debt repayment is self-explanatory and can include student loans and/or credit card payments.

Retirement: Retirement contributions to a retirement plan such as a 401k or 403b.

This plan basically has the pay yourself first feature build in. You automate virtually everything. The 20% savings like 401k contributions and long-term savings are automatically deducted. Then you have 60% for committed expenses and the remaining 20% for fun money and irregular expenses.

How I stack up: Basically I don’t. My committed expenses are way too high. Also under the 60% solution, I include my monthly hair appointments and groceries in my committed expenses whereas under the Debt Diet plan, I classify those expenses as Personal Expenses. So basically, the 60% solution is more flexible than the Debt Diet plan, which is why in the short-term the Debt Diet plan would be best to curtail my personal expenditure so that I can contribute more towards debt repayment.

In the long-term, I am hoping to bring my spending more in line with the 60% Solution because it completely takes the thinking out of it. I won’t ever allocate more than 20% towards fun money and irregular expenses so once my student loans are repaid, all of the extra cash flow will go directly into long-term savings and retirement contributions.

Monday, May 01, 2006

April 2006 Comparison to the Debt Diet Plan…

Debt Diet: My actual spending definitely does not conform to the Debt Diet plan.

Housing: I have little control over this figure for now. Currently, I am focusing on paying off my HELOC which totals approximately $25,700 and hopefully with a salary increase next year I will fall more in line with the recommended 35% ratio.

Debt: Currently I don’t pay anything on my student loans and the interest is capitalizing to the tune of ~$500/month. Debt repayment will begin 6-9 months following my May 2007 graduation.

Transportation: Thank goodness one category meets the recommended ratio. I anticipate this figure to improve after my May graduation next year since I will no longer need to drive downtown and park. I can revert back to taking the train.

Expenses: I need to focus on reducing personal expenses. I have a lot of control over my spending so I definitely need to do better in this area. I am getting better but there is always room for more improvement.

Savings: No after-tax savings at this time. Right now and I’m focused on paying off debt. I do however contribute 5% of my gross salary to my 401k, which my employer matches. So every month, ~$450 goes into my 401k.

Friday, April 28, 2006

Balance Transfer to Refinance HELOC…

I was thinking that I could transfer the balance of the HELOC (Currently at 10.25% or Prime + 2.5%) to a lower rate credit card, which will free up a portion of the $220 in interest that I pay per month.

The only downside I see to this is that I lose out on the mortgage interest deduction. I am hoping to have it paid off/refinanced before the end of the year but this transaction might save in excess of $1,000, which is probably a bigger benefit than the tax deduction. So far I have a 1.9% offer but it carries a fee that I can probably get waived.

I also opened a letter from my mortgage company today which said that I was pre-approved for a $20,000 increase in my home equity line. I initiated the increase just because I am currently maxed out on the line and the increase will improve my credit score if anything. There is a negative impact on your credit score the closer you are to the credit limit.

What do you think?

Thursday, April 27, 2006

April Net Worth Recap…

Snapshot:

~ $400 over budget

Car loan got paid off

Only a $257 decline in net worth!

Eating out:

I got lazy in the last week. I stopped preparing lunches and cooking dinner and ate out a lot. $121 or 55% of eating out for the month came just in the last week alone.

Irregular expenses:

Irregular expenses for the month totaled $445 and primarily include: highlights $85 (every 4 months), clubhouse deposit $200, and the quarterly water bill $132. The irregular expenses basically account for the $400 over budget balance. Following my best friend’s bridal shower, I will be refunded $150 of the clubhouse deposit.

Personal expenses:

I also did not anticipate spending $103 in hair supplies this month. Vanity is expensive.

Summary:

This was a very good month and the best spending month in almost 6 years. I decided to stick with the Kelly Blue Book trade-in value for my auto to be conservative but I also added in my vested pension balance and restated my net worth. Now my net worth is ($57,208) as opposed to ($68,350). =) My car loan is now paid off so that means $500 in extra cash flow each month. I already committed $200 in extra cash to help pay down my HELOC in the coming months. Next month, I hope to curb the eating out expense even more and expect at least a $3000-3500 decline in my net worth since I have to pay for my summer class and books.

Go Chitowngirl…Improvement is in the works!!! =)

Wednesday, April 26, 2006

Used Car Value...

Kelley Blue Book: $12,485

Edmonds: $13,484

Nada: $15,875

I am going to go with the middle value in my net worth calculation.

Edmonds or Kelley Blue Book…

Kelley Blue Book valued my car last month at $12,085.

Edmonds is valuing my car today at $15,895 for trade-in-value.

It is a 2002 Nissan with just 39,000 miles and it’s in good condition.

What do you think? Of course you know I want to use the value from Edmonds. =)

Payday Looms…

I get to tally everything up for the month tonight and report the madness tomorrow morning. I also get to update my profile on networthiq.com and restate my net worth including my pension in my retirement assets. This should help out a lot.

All in all, I think I was overbudget by ~ $400. Bummer.

Tuesday, April 25, 2006

Getting Financially Lazy…

Monday, April 24, 2006

$40 Gas…

I am so glad that I will be dropping down to 2 days of driving per week because gas prices are starting to take a big bit on the budget.

Weekend Update and Month End Looming…

Next month, I will have at least a $3,000 - $4,000 dip in my net worth because I have to pay for my summer class and books. Bummer but the end of school is near and I can finally see the light...One more year. (Chitowngirl is doing a dance over here!)

Wednesday, April 19, 2006

Success Story…

Reading success stories of regular people working hard gives me hope that I will be debt free too one day. =)

Employee Pension Plan…

I always knew that my employer had both a pension plan and a 401k plan. I never thought to include my pension plan in my net worth calculation because 1) I didn’t know how and 2) I was too lazy to figure it out. But I did some research today on the company’s website and have some good news to report.

401(k): My employer matches 100% of my 401k contributions up to 5% of my gross salary.

Account Balance: ~ $16,500

Employer Funded Pension: My pension is now fully vested and transferable, which means that I can take my vested account balance with me when I leave the company, no matter what my age is. Additionally, the pension plan has a long history and I have a very stable employer.

Account Balance: ~ $11,400.

So my total retirement benefits total $27,900. Oh yeah baby!!!

*When I do this month’s totals on networthiq.com, I will restate my net worth. =)

Tuesday, April 18, 2006

Make Movies Affordable…

Federal Student Loan Consolidation…

I have to once again consolidate my student loans by June 1st to lock in a low rate of approximately 4.75%. After that, interest rates are rising to 6.8% for new Stafford loans and 8.5% for Plus loans. Ouch!!! I wonder how long student loan debt will be considered good debt if the interest rates are so high. Yahoo! had an article on it today. See here.

Unfortunately for me, I need to borrow for my last year of school and will not be able to consolidate those loans before the June 1st deadline. Therefore, I will have to borrower at the higher rate. Bummer. I also won’t be consolidating the last year of federal loans because they take a weighted average approach in fixing the interest rate. All in all, I will have about $55,000 fixed at approximately 4% and the rest of my student loan debt will have higher interest rates. Total Bummer but more incentive to pay the loans off quicker.

Saturday, April 15, 2006

Preparation for Graduation...

So anyway...the plan is to pay off/refinance my home equity line by the end of September. This will free up another $200 in cash for a total of $900 in net free cash flow. Once the home equity line if paid off, the plan is to put any extra money into an emergency fund. With the inclusion of my student loans, my monthly expenses are going to skyrocket so I tried to calculate an adequate emergency fund. My short-term goal is 3 months or $14,000 which should be attainable with tuition reimbursement, any additional aid money, bonus and my tax return. I need to make sure that I can stash enough cash away to make sure that I can pay the monthly payments on my student loans should I not find a law job right away. I also have the option of placing some of the loans in forbearance should I need to do so. I hope not. So that’s the plan...I know I can do it.

*** I took a conservative approach to my emergency fund calculation:

- $200 in extra transportation (outside of insurance)

- $400 for health insurance (arbitrarily)

- Kept my standard of living the same

- Factored in full payment for student loans(I'm on a graudated payment schedule)

- Provided a $300 cushion

Thursday, April 13, 2006

Emergency Fund…

Is that right? I don’t think so anymore. I’ve read several things including the following:

Save 3-6 months of living expenses

Save 3-6 months of gross salary

Save 3-6 months of take home pay

Financial Train Wreck has a $12,000 emergency fund goal. Today he explained how he got to that figure after being prompted by a question from Mapgirl who has a $4,000 savings goal.

It is a really good post and informative as well. One major thing that I overlooked in my calculation was the cost of insurance and a cushion allowance for unexpected expenses and also expenses related to finding new employment. Needless to say...I have to go back to the drawing board.

So… How do you calculate the ideal amount of your emergency reserve?

Wednesday, April 12, 2006

Preparation is Key…

Tuesday, April 11, 2006

Help…

Debt Diet Monthly Spending Plan…

Note: I contribute 5% of my gross salary to my 401k and my employer matches it 100%. Take home pay is after 401k contributions, taxes, health care and insurance. These come out of my check each month before I take anything home.

Housing: First and second mortgage, assessments, security, electric, phone, cell phone, internet, and cable.

Debt: Currently I am paying additional on my home equity line to pay it off. Interest on my student loans is now capitalizing. The loans are not in prepayment while I am still in school.

Transportation: Car insurance, gas, parking.

Other: Hair salon visits (every other week), groceries, irregular expenses such as gifts and non-recurring expenses, and personal spending money.

Savings: Short-term and long-term.

Comments: This method is an eye opener for sure. I cannot tell you how horrible of a mess I was before I paid off my car loan just one week ago. Previously, my transportation ratio was 29% of my take home pay. Ouch!!!

As you can see, my housing ratio is extremely high. As a result, I have little to no additional income to put towards repayment of debt. After paying off my home equity line of credit this year, the housing ratio will only improve slightly and still be too high for my current income level. I resolve for now to stay in my condo. I only have one more year of law school after which I anticipate earning a higher salary.

By putting the figures into place, I have a better understanding of discretionary expenses versus committed expenses. This method allowed me see that I could decrease my discretionary expenses to put an extra $200 towards my home equity line.

My best friend's wedding is the only major planned expense for this year. I placed $500 in a separate checking account to contribute towards any additional wedding expenses. My dress is already paid for and I already booked the facility for her Bridal Shower. Plus, there are 8 other bridesmaids to contribute to expenses. =)

BTW...this while HTML thing is so hard but hopefully I will get it figured out soon. =)

Sunday, April 09, 2006

Condo Market Value...

The value of the condos in my complex have always outpaced hers so it was very interesting when I saw a 3 bedroom, 2 bathroom unit on the market for $175,000 in her complex. The description does say the unit was newly rehabbed with whirlpool tub, new kitchen with granite counter tops, hardwood flooring in living room, dining room and kitchen, carpeted bedrooms, recessed lights, and all new drywall. This sounds like the place was a mess and they did a complete gut rehab.

I have a 3 bedroom, 2 bath unit. I recently put in wood flooring in the living room, dining room, and kitchen and also replaced the carpeting in the bedrooms. With the exception of my washer/dryer unit, all of my appliances are relatively new and in wonderful shape. Actually, my unit in and of itself is very nice and in good shape.

I currently value my unit at $150,000. Even though I didn’t do a gut rehab because it didn’t need it, I wonder if I am undervaluing my condo unit. Zillow.com estimates the value at $171,000. It will be very interesting to see what the unit sells for and I will be keeping my eye out for notices of recent sales. This could prove wonderful for my net worth...Any improvement would be great. =)

Friday, April 07, 2006

Oprah’s Debt Diet...

I see a lot of myself in Brenda Bradley. She wanted the big house, the fancy cars, she liked to shop, eat out, etc. Well...who the heck doesn’t? I certainly do and I got a lot of things to my detriment. The difference between me and Brenda Bradley is that I decided to do something sooner rather than later. I decided to change my behavior before I could have the chance to put the financial and emotional drain on a marriage or hamper my children’s future. That is the only difference. Financial awakening happens for people at different times. I feel so grateful that the time for me is NOW.

I went on the message boards and saw the mean comments about the Bradley’s and Brenda in particular. Quite frankly, I was appalled at what I read. Why judge? Some people spend for a variety of reasons and everyone has had a different upbringing. Some were exposed to financial lessons, others learned from what they saw. As Oprah said... “When you know better...You can do better!” She said this one day and it struck a cord. I know my spending behavior is hurting me now and the more I continue down this destructive path, the more it is going to hurt my future.

I am thankful for the show and I am thankful that these families had the courage to put it all out there and make a positive change in their lives. So instead of judging, I salute them and I hope they have much success because...

When you know better...You can do better!!!

Thursday, April 06, 2006

Free Food…

Fighting the Shopping Urge…

The thing is that I don’t “need” anything. My current workplace has a business casual dress policy but with graduation approaching, I am thinking that I need to purchase more suiting rather than casual clothes. A nice suit can cost but in actuality it saves in the long run financially. You can wear a suit more than once and just change out the shell or blouse. Right now, it costs $8 to get a twin set cleaned because they count each item separately. Dryel is my friend and I swear they totally cheat women at the dry cleaners but I will save that rant for another day. (Chitowngirl takes in deep breaths… LOL) Plus it saves time because it makes deciding what to wear a whole lot easier.

So…future investments in work clothing will have a bigger focus on acquiring suits. Now I don’t have the huge urge to shop because I don’t have the money to spend $100’s on a suit.

Done deal. =)

Wednesday, April 05, 2006

Excited…

Financially I may not be where I thought I would be at this time in my life (quickly approaching thirty) but I am healthy, I have a wonderful family, I have a home, a job, and I am almost through with law school. I’ve accomplished a lot in the last three years and for that, I need to hold my head up high.

For the past 3 years, I have worked my butt off going to school 4 nights a week while working full time. I even made the Dean’s List last semester. =) I could have taken the easy route and quit working and lived completely off financial aid but I can promise you…the net worth chart on this page would look a whole lot worse. While I stumbled pretty badly along the way…I am still standing and I know things will get better if I continue to work hard and make the best decisions possible.

Staying positive is the best antidote to having tons of debt. =)

Next Goal…

Shortly after that, I should graduate from law school with just my first mortgage and student loan debt. Then my hope is to pay off the student loans in chunks, starting with the private loans. My federal loans have a very low interest rate so I won’t worry much about those in the near future. The interest rates on the private loans are much higher so I will pay those off with any extra money coming into the house such as bonuses and any tax returns that I receive. I plan to use the snowball method to pay them off from the smallest loan amount (~ $5,000) to the highest loan amount (~ $21,000). I do not plan to reduce my retirement contribution just because the student loans come due but this method will free up additional cash flow along the way.

Tuesday, April 04, 2006

Slippery Slope…

So today I spent $4 on snacks…I need to reel it in before it gets out of hand. I would rather use my discretionary money to make a meaningful purchase like a new pair of workout shoes, a small stock investment, or save for a vacation. That is meaningful...not snacks that spend a second on the lips and a lifetime on the hips. LOL.

Car Loan Paid Off…

The pay off depleted most of my savings but it just made sense. I wasn’t earning nearly as much interest in my checking account as I was paying on the car loan, which was at approximately 5.6%. Next step will be to pay off my $25,000 home equity line and then all I will have in the way of debts is my first mortgage and my student loans.

Currently my home equity line of credit is at Prime + 2.5%, or 10.25%. The rate is so high because at the initial purchase, the loan to value was 100%. I’ve been rather lazy at refinancing the loan, which could give me an interest rate at Prime or even Subprime. I need to get on it! (Chitowngirl shakes her head) I don’t feel that bad about the home equity line because it is not debt that I acquired by personal spending. It was the result of an 80/20 mortgage, which is what I needed to buy my place at the time. My condo has appreciated approximately $20,000 since I bought it three years ago and I recently did some remodeling (I know…don’t blast me!!!) which cost me thousands to put in new wood floors, carpeting in three bedrooms, and to re-stain my kitchen cabinets as opposed to replacing them.

When I look back on it, I know I should have held off on the complete overhaul and just put down new carper. It had to be replaced. White carpet just does not work well in the City of Unpredictable Weather. Plus…I just told you… I am lazy about some things so I hardly ever took my shoes off right away. Now with the floors…I have no worries.

One more reason why I did the project was that I knew I would be in my place for a while to come. Why? I simply cannot afford anything else with the mounting student loans, no guaranteed higher paying position after school is over, and rising real estate prices and interest rates. So, I finally made it feel like home and I settled in for the long run…at least 5 years.

Chitowngirl does a little dance…Car loan…PAID!!!

Monday, April 03, 2006

Confession…

My financial tailspin began my freshman year of college. I ran out of money…on the weekend nonetheless. So Mom and Dad couldn’t just deposit available funds into my account or drive 50 miles up the north shore to bring me some cash. I remember being embarrassed. A few of my friends had asked me to do out to dinner with them and I said sure. I thought I had money…Chitowngirl was never without money. I made up some lame excuse for why I couldn’t go with them and then called my Mom crying…which made her feel bad…like she was a bad Mom for not providing for me.

6 years later, I STILL feel bad and ashamed of this because my parents are wonderful and have ALWAYS provided for me. It was completely my fault that I ran out of money in the first place. I blew through it like it was nothing. I didn’t realize or mentally process that I was spending my parents’ hard earned money. I didn’t know the value of a dollar.

Soon after, I tried to get a credit card but was denied for lack of financial history. I didn’t try for the cheesy t-shirt cards. A few months later…not only did I get approved for a credit card, but I got pre-approved for a credit card with a limit of $11,000. What on earth would a 19/20 year old do with that kind of credit limit? All in all, I graduated with $4,000 in credit card debt.

6 years later… I am still learning. Except now, I am spending my hard earned money and realizing just how much I have to work to buy this or that. When I think about having to work two weeks just to buy something, it makes me not want it that bad. Right now I feel like I placed myself into a form of servitude…working to pay off my debt.

I wasn’t a rich kid. I come from a middle class family who worked hard to give their children the best opportunities in life. I just didn’t understand the value of a dollar. I DO NOW! =)

It’s Raining Like Cats and Dogs…

One good thing…This morning while running late, I remembered that now that I will be riding the train, I won’t get home tonight until roughly 10:30. Ouch!!! So, I needed to pack a snack for the train ride home, which will constitute my dinner. The bad part…the sandwich I made was a quick PB&J sandwich but the good part…I saved about $5-7 by making it. =)

Sunday, April 02, 2006

Another Day…Another Good Day…

I have to thank my Mom and Dad for the dinner invite and my Mom for making a wonderful meal. I even have leftovers for lunch tomorrow. =)

I am kind of dreading work tomorrow. A main expressway in Chicago is getting a major overhaul over the next 2 years and they didn’t even ask my permission for the inconvenience. LOL. I drive it 3 days a week and now I’ve been banished to the train. It’s cool…we have an awesome train system that will get me to and from work and school just fine. You have to be grateful for something like that.

Chitowngirl is doing a happy dance over here!!! I had a wonderful weekend. =)

Saturday, April 01, 2006

Grocery Shopping…

The Grand Total….A whopping $122!!!

I know that seems like a lot but I have to tell you that I am so pleased with my shopping experience. You’ll see why…

I already had frozen chicken breast in the deep freezer but that was it. So I decided to go to Sam’s Club and get all the rest of my meats for the month to add some variety. While there I found that they had frozen salmon individually wrapped. Since salmon was on my grocery list already, I decided this would probably work out more economically and last for several more months. Good find indeed. Also while I was there, I decided to get a few other cuts of meat (steak and pork chops) and immediately came home and individually wrapped them in freezer bags. This will make defrosting and portion control a lot easier. Thanks Rachel Ray for the tip!!!

So all in all, I have meat covered not just for one month but at least two or more. This is definitely a thumbs up for Chitowngirl!!!

I rounded off the remainder of my shopping with soda, veggies for the week, what I need to make cold cut sandwiches, and a few household toiletries. I am so covered it is not even funny. No fast food for me. LOL.

My monthly grocery/household budget is $150. So I still have some money left to purchase fresh veggies, frozen if they go on sale, and/or any other needs. I should make it just fine.

*** I have to say this because I am so tickled. It is already the third day into this month’s budget and I only spent $5 in discretionary money out of $300. Usually, I would have already blown through at least $40 bucks. This blog and is already starting to help. Oh yeah baby!!!

Just Rambling...

I woke up this morning exhausted. I cannot wait for this law school thing to end. Working full-time and going to school part-time is no joke. I get on average about 5 hours of sleep every night. Wowsa!!! So by the weekend, I am trying to log in as much sleep as I can. LOL.

So right now, I am making a grocery list and checking it twice. When I get to the store, I am going to find out if I’m naughty or nice. LOL. I just really hope that I can stick to my budget and what’s on my list. I am trying to think of realistic things to prepare that would be easy to transport to work.

I also need to wash my car this weekend. To cut costs, I am going to drag my vacuum out to the garage and clean it out with the attachments and then spend just $3-5 with my coupon to wash the outside. In Chicago you have to make sure you don’t keep too much salt on your car because it will eat away at the paint. (At least I think that's true. LOL)

So this weekend, I am trying to spend as little discretionary money as possible. I tend to go a little crazy on the weekend but if I really want to keep my spending to my earnings and not use any debt, then my new budget only allows $300 to spend on whatever I want. Now I thought about it...What do I really want? Some new workout shoes, highlights for my hair, and I want to be DEBT FREE. I made it so that any eating out comes from my discretionary money so I have an incentive to stick with the food I buy with my grocery budget and eat at home. With the leftover money, I can either 1) open a Sharebuilder account, 2) open a high yield savings account or 3) allocate it to my home equity line.

I don't have any credit card debt. Outside of my student loans, the only debt I have is my car loan that I’m paying off this month with my savings and my HELOC (never used for personal expense, just the home purchase). So any extra money should go to my HELOC or to savings. I don't want it sitting in my checking account. Dangerous I tell you...Dangerous. =)

Have a wonderful weekend everyone!!!